Even the most fervent climate change cynics cannot deny that the effects of climate change are becoming more obvious every day. Whether this is news or opinion pieces in a newspaper suggesting that when the polar icecaps melt, they will cool the gulf stream and create another ice age. Add to this current weather anomalies occurring in Spain, where there is a serious draught and summer weather throughout winter, whilst other parts of the world are being buffeted by freak storms and extreme weather conditions.

The severity of the situation calls for much more than simply reducing the global carbon footprint, it is essential that we need to be moving towards zero carbon emissions to have any hope of halting the inevitable. This would require a wholesale shift towards the adoption of renewable energy on a global scale.

The good news is that renewable energy is inexhaustible, unlike fossil fuels which have a finite supply, we will not run out of wind or solar energy. So far so good, but there is the small problem of moving renewable energy around the globe.

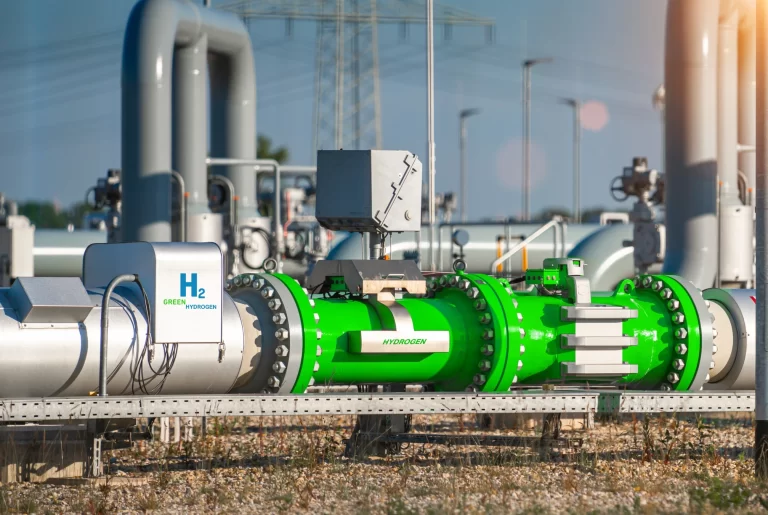

According to the Economist Impact website “Hydrogen: why this time is different”, the energy generated from renewable sources can be used to produce green hydrogen, which can then be used as a means of energy storage and distribution. This would allow the movement of renewable power around the world without losing energy as is the case when moving electricity.

It could provide a cost-effective method of short to medium- term electricity storage. Hydrogen based fuels and hydrogen allows for the electricity generated by solar power in one part of the world to be easily transported to others, which require energy but don’t have the means to produce it.

Hydrogen could be an integral part in the production, storage, transportation and different uses of renewable energy. As a gas, it can be move via pipelines or by ship in its liquid form. There are three types of hydrogen: grey hydrogen extracted from fossil gas and releases CO2 emissions into the air, blue hydrogen is also extracted from fossil gas, CO2 emissions are trapped and stored below ground. Whereas green hydrogen is created via electrolysis using renewable electricity to split water into hydrogen and releases oxygen into the air.

The Economist also reports that Goldman Sachs forecast that by 2050 green hydrogen could account for 25 per cent of the world’s energy requirements, with an estimated market value of around 10trillion US dollars. Similarly, PWC predicts that hydrogen could take the place of 10.4 billion barrels of oil equivalent by 2050. The hydrogen supply chain industry is expected to create over 400,000 jobs worldwide. Throughout this same period of time, The Hydrogen Council suggest the adoption of green hydrogen would result in an 18 per cent reduction in carbon emissions (based on today’s volumes).

An recent article in the Guardian (published 13th February 2024, asks “Will hydrogen overtake batteries in the race for zero-emission cars?” As part of a series exploring the technology and myths surrounding electric vehicles, they explain the benefits of hydrogen and suggest that it will be the green fuel of the future. The article examines whether hydrogen will take over the EV car battery, with relation to the worries over EV car fires, battery mining issue and the associated costs of driving an electric vehicle.

Toyota’s chairman, Akio Toyoda, stated in January 2024, that he believes battery cars would peak at 30%, and that hydrogen and internal combustion engines will account for the remainder. Toyota produces the Mirai car, one of the few hydrogen-powered cars currently available.

John Matthews, Sales and Marketing Director and Co-Founder of RA-ESG explained, “Access to affordable renewable energy and working towards zero emissions is at the core of RA-ESG’s corporate vision. This is why our financial analysts focus on identifying the best alternative investment opportunities that fit in with our sustainable investing strategy.

“RA-ESG operates a dual investment strategy, whereby the lion’s share of funds is invested into tried and tested renewable energy generation projects, and a smaller percentage is ploughed into higher risk research and development projects, which offer the possibility of higher returns.

Needless to say, we are closely monitoring the debate about green hydrogen and continue to deliver the best new investment opportunities within the renewables market.”

If you would like to know more about RA-ESG.com’s ESG investing opportunities and investment bonds, visit www.ra-esg.com or email info@raesg.x-co.dev.